3 Problems with Involving Your Wholesaler in Premium Financing (and How to Solve Them)

January 11th, 2024 | 6 min. read

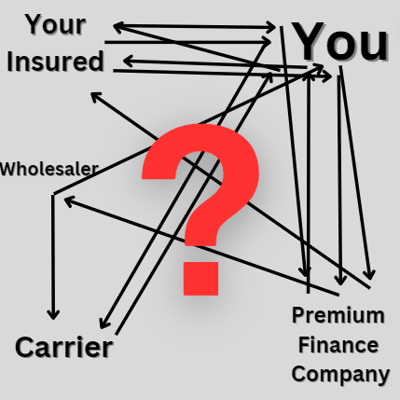

As a retail insurance agent, have you ever wondered how your premium finance company interacts with your wholesaler? There’s often some confusion about the stance that your wholesale broker may take when dealing with placements that have been premium financed. I’ll help to clarify this a bit here.

Clearly, there are times where it is appropriate for you to use premium financing options to help your insureds finance the sometimes-burdensome costs of insurance. However, there’s rarely a need to have your wholesaler involved in the financial arrangements at all. And when you allow a premium finance company to pay a wholesaler on your behalf, you could be creating three new problems for yourself:

- Confusion for your own agency about how much the wholesaler has been paid for the policy.

- Potentially delayed payments to the carrier.

- Increasing the risk of your wholesaler accidentally sharing sensitive information about your insured in the process.

I’ll explain how these problems arise as we go. But, first let’s set up a typical scenario where premium financing is put in play when you involve your wholesaler. If you’ve put together a premium finance arrangement before, you’re already familiar with how this works, but I’ll lay it out here just as a refresher.

The Typical Financing Scenario

In most scenarios where an insured needs to finance their insurance policy, you, the retail agent/broker, arranges premium financing for the insured client at or just before the time of binding coverage with your wholesaler. That arrangement involves a direct relationship between you and your chosen premium finance company. The process usually looks something like this:

- You negotiate down payment, terms, and interest rates with the finance company of your choosing.

- The premium finance company produces a contract that you present to your insured for review.

- Once reviewed and accepted, your insured sends the signed contract back to you.

- You discuss how to collect the required down payment from your insured.

- You forward that signed contract to the finance company for processing.

- You bind the policy with your wholesaler.

- Your wholesaler binds the policy with the carrier and bills you for the appropriate amounts due.

- The finance company will, of course, pay the remaining balance to you within a few days so that you can pay the wholesaler in full.

- Then, the finance company will start billing the insured for the agreed installment payments.

As you can see, the process of putting financing in place already has a lot of moving parts, so there’s no reason to complicate it further and potentially create more errors or delays. Notice that your wholesaler is not at all involved in the negotiations or provision of any premium financing for your insured. This is important and we’ll address this later.

Money Problems and Delayed Starts

It’s always cleaner and faster to arrange for the finance company to pay you directly so that you can match their funds with the initial down payment from the insured and know that you have a full payment ready to send to your wholesaler on time.

I’m not entirely sure why finance companies would want to bypass you in the first place, but it can certainly lead to the following three problems that can be easily avoided.

Potential Problem #1 – Where’s the Money?

In step #8 above, there are occasions when the premium finance company will bypass you and send their balance-payment directly to the wholesaler. Now you are left to wonder if the premium finance company is sending the correct amount or not. And remember, your wholesaler has no relationship with the finance company, so they have no ability to resolve any mistake the finance company made.

You might be shocked to learn from our many years of experience as healthcare professional liability wholesalers that these checks are often sent with incorrect amounts. Sometimes we receive overpayments from your finance company. Other times, we are underpaid, which creates the next problem.

Potential Problem #2 – Payment Delays

When your wholesaler is underpaid, they'll have to delay payment to the carrier since the carrier expects full payment by the due date they give to your wholesaler. Then, your wholesaler must contact you for the underpaid amount, and you’ll have to unravel the mystery of how much the finance company sent to the wholesaler because you weren’t directly involved. This usually takes extra time (days) to fix, which eats away at looming payment deadlines.

Potential Problem #3 – Loss of Private Info

In situations where a finance company bypasses you and sends a check directly to your wholesaler, prior to sending the check, the premium finance company will try to contact your wholesaler to verify all kinds of private information about the actual policy, carrier and insured involved in the placement. This is usually done by phone where a person the wholesaler doesn’t know will call and say that they represent a finance company looking for details about a policy the wholesaler supposedly placed. They will ask for all sorts of information, like names, a policy number, premium amounts or other terms of the policy, the carrier and effective date, etc. Certainly, no data a licensed broker should be handing out randomly over the phone or in writing to a complete stranger.

I can understand that the premium finance folks are trying to verify the details of the placement that was given to them by you, but don’t they trust the information you’ve already given them? So, it seems strange to me that they would just randomly expect a wholesaler that they have no direct relationship with to provide such sensitive information about your insured and your deal over the phone or via email. More worrisome, in my opinion, is the number of wholesalers who will give out this information willingly and without vetting the party making the inquiry.

Unfortunately, we’ve seen some premium finance inquiries come to us that were very insistent, pushy, and sometimes just downright rude, aggressively insisting we should just hand out such information so recklessly! That wouldn’t be a safe or prudent thing to do with your information. I’m not sure why a premium finance company would act this way when there’s such an easy way to resolve what they’re looking for by contacting you directly instead of your wholesaler.

The Solution

So, at Ethos, we have an internal policy of NOT providing such information in that manner. You don’t want your wholesaler to give away important information about you, your insured, and their policy to a complete stranger (or worse yet a scammer). Especially when the solution is so simple!

We encourage you to use the tools you need to keep us out of it and reduce the chance for errors or data breaches. While finalizing the contract with your finance company, you can simply provide them with a copy of the binder document which contains all the same information that they need to verify. After all, the binder document is produced by the carrier rather than us, so it can’t get any more official than that!

By the way, that’s what we’ll tell any finance company that contacts us in such a situation… we’ll just redirect them back to you to get a copy of the binder document which contains everything they need to know about that the placement so that they can verify the legitimacy of the deal.

Keeping It Simple

It’s always struck me a little odd that premium finance companies would want to involve a wholesaler needlessly in a process that only involves you and your insured. Obviously, there’s no direct relationship with a wholesaler needed to finance most policies, and it’s just better and easier to have one less party involved. By doing so, you ensure a smoother process for your insured that keeps you in control and your client’s data secure.

Jonathan, the Co-Founder and Chief Operating Officer of Ethos since its inception in 2004, has had a distinguished insurance career dating back to 1992. Beginning as an underwriter specializing in medical liability insurance for PHICO Group, he progressed to roles with Frontier Insurance Group and National Specialty Underwriters, Inc., before co-founding Ethos in 2004. Jonathan's background as a med-mal underwriter and in the wholesale market uniquely positions him to drive operational excellence at Ethos, utilizing his expertise in identifying data patterns. He has contributed to industry dialogue through his blog articles and participation as a panelist at events such as PLUS. Beyond his professional pursuits, Jonathan finds joy in family, a wide range of hobbies including music and sports.